INDUSTRY SNAPSHOT

2022 Georgia Ecosystem Report

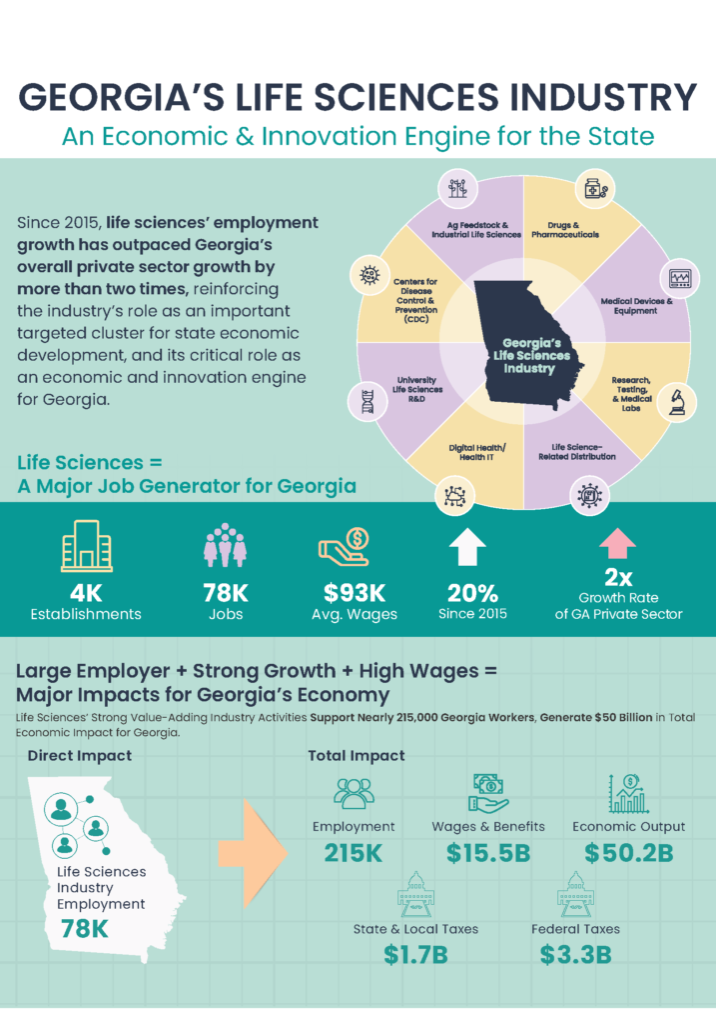

Since 2015, life sciences’ employment growth has outpaced Georgia’s overall private sector growth by more than two times, reinforcing the industry’s role as an important targeted cluster for state economic development, and its critical role as an economic and innovation engine for Georgia.

The U.S. Bioscience Industry: Fostering Innovation and Driving America’s Economy Forward

The 10th biennial TEConomy/BIO report focuses on the economic footprint of the industry geographically including the latest trends in the bioscience industry for the nation, states, and metropolitan areas. Check out state-by-state information on the performance of the bioscience economy.

ADDITIONAL RESOUCES

This report, which reviewed public policy strategies and programs in all 50 states, highlights new and innovative initiatives that enhance the future of the bioscience industry. In addition to several evaluations of specific state and policy examples, the report identified seven national trends for state bioscience growth in 2021:

- States are building career pathways for future biosciences talent.

- States and regions are implementing an overall supportive regulatory climate to ensure predictable and stable regulatory treatment of biosciences firms.

- States and regions are focusing on developing their agricultural, industrial, and environmental bioscience sectors in addition to their biomedical and health sectors.

- Physical infrastructure and facilities remain a priority.

- Universities and other research centers’ technology transfer efforts are better understood by public agencies.

- Proximity to academic innovation is a driving influence.

- Increased focus on biomanufacturing is the future.

Since it was established more than 75 years ago, the Centers for Disease Control and Prevention (CDC) has focused on issues of global health significance.

CDC’s Center for Global Health (CGH) 2022 Annual Report highlights how our work with global health partners and other U.S. government agencies addresses global health threats. This report, titled "Center for Global Health: Making an Impact Through Global Partnerships," outlines CGH's collaborative efforts to respond to the COVID-19 pandemic and promote health equity and capacity development. The report emphasizes the importance of global partnerships by highlighting field experiences and success stories.

Themes featured in the report include:

- CDC’s Technical Expertise and Partnerships Promote Health Security and Global Good: CDC experts, both in-country staff and subject matter experts from across the agency, provide specialized scientific and program support to country and regional partners, multilateral organizations, and other U.S. government agencies to detect, prevent and control emerging diseases, disease outbreaks, natural disasters, and environmental disasters.

- Global Programs Help Countries Adapt to COVID-19: Decades of collaboration with partner countries and multilateral institutions on global health security have helped serve as strong foundations for COVID-19 pandemic response efforts around the world.

- CDC Provides Technical Assistance to COVID-19 Vaccine Rollout: CDC’s global COVID-19 activities help enhance response capabilities and simultaneously build long-term, sustainable capacity for response to future highly communicable diseases.

- Global Partnerships Save Lives: CDC has over 60 country offices that work with ministries of health and other partners on the front lines. Although CDC’s overseas offices include staff assigned to country offices, most of its overseas workforce are locally employed staff from the countries in which it works. CDC only works in countries that request our technical assistance and the collaboration is uniquely designed to be owned and led by partner countries.

Georgia is one of the nation’s leading global health and life science centers, with a critical mass of bioscience organizations and companies leading innovations for the industry. Existing companies and new arrivals have access to a highly educated workforce, renowned research institutions, cutting-edge technological resources and global access through Hartsfield-Jackson Atlanta International Airport. Georgia’s business-friendly climate is consistently ranked among the best in the country with incentives that encourage growth among bio companies.

- The market has never been stronger.

All-time highs reached in funding, job growth, demand for lab space and new construction. - Premier markets lead and surprises emerge in the Sun Belt.

Boston, San Francisco, and San Diego remain the dominant markets. Raleigh-Durham, Philadelphia and Washington, D.C. are rising rapidly. Dallas, Atlanta and Phoenix begin to emerge. - The near-term outlook remains bright.

Data trends and sentiment from the field suggest continued active market conditions over the next year.

The U.S. health system demonstrated resilience and flexibility during 2020, recovering toward its pre-pandemic levels of activity and progressing into 2021, even as the backlog of missed or delayed activity remains substantial. Medicine supply was largely maintained and spending on medicines increased by less than 1% on a net price basis.

Key findings in the report:

- Net medicine spending increased 0.8% to $359 billion—but real net per capita spending declined to $1,085, which amounts to an increase of just $56 since 2010.

- Brand list prices increased by 4.4%—but net prices fell by 2.9%. Meanwhile, 2020 was the fourth year in a row that net prices grew at or below the Consumer Price Index (CPI).

- Only 8% of all patients had annual out-of-pocket medicine costs above $500—and that’s in the midst of a pandemic.

- But 17% of Medicare beneficiaries had annual cost-sharing above this amount—reflecting the design of the Part D benefit, which is in need of reform.

America’s food and agriculture sectors feed the economy and fortify the nation. Together, they are responsible for roughly one-fifth of the country’s economic activity, directly supporting nearly 20 million jobs; that equals more than 13% of US employment.

It begins in the rich soil of America’s farms and ranches – more than 2 million of them – spread across the heartland and stretching to the coasts, covering two out of every five American acres.

Meanwhile, millions of food scientists, grocers and truck-drivers work in more than 200,000 food manufacturing, processing, and storage facilities, to keep food fresh and deliver it on time.

The journey may conclude at one of the nation’s many restaurant locations or make its way from retail grocers to American homes where families are grateful for the nation’s bounty.

Georgia’s bioscience industry is a strategic and growing technology component of the overall U.S. economy. American bioscience innovation in health, energy, and agriculture supports state & local communities in a variety of ways ranging from job creation, construction, tax revenues, and other economic impact values. Driven by small-company innovators, this valued industry is also mobilizing in an unprecedented manner to address the global COVID-19 pandemic, and other life-saving and life-enhancing products and services for the U.S. and elsewhere. America’s bioscience industry has never been more important, both for our health and our economic recovery.

This ninth biennial TEConomy/BIO report focuses on the economic footprint of the industry geographically including the latest trends in the bioscience industry for the nation, states, and metropolitan areas. Check out state-by-state information on the performance of the bioscience economy.

New approaches are required at almost every level of the economy. Biotechnology has the potential to be a transformative asset in this struggle, offering vital contributions to near-term greenhouse gas (GHG) reductions and revolutionary tools to avert catastrophic climate change in the longer term. New biotech tools, including gene

editing and synthetic biology, can be transformative climate solutions in key emerging industry sectors. Policies supporting the development and deployment of biotech climate solutions should be part of any government effort to address climate change.

Biotechnology can achieve at least 3 billion tons of CO2 equivalent mitigation annually by 2030, using existing technologies, and emerging biotechnologies could have transformative GHG benefits in a range of industrial sectors. Biotechnology can deliver vital climate solutions in four key areas:

- Producing sustainable biomass feedstock

- Empowering sustainable production

- Developing lower carbon products

- Enhancing carbon sequestration

In 2020, BIO partnered, for the second consecutive year, with Coqual, an industry-leading think tank devoted to diversity, equity, and inclusion (DEI) in the workplace, to investigate the state of DEI in the biotechnology industry.

This report analyzes the findings from a voluntary survey sent to BIO member companies, fielded in the fall of 2020. Data is included from the 100 companies who responded. To measure year-over-year progress on DEI in the industry, the report also notes, where possible, shifts from BIO’s inaugural 2019 report, “Measuring Diversity in the Biotech Industry: Building an Inclusive Workforce.”

Georgia Bio in partnership with the Georgia Global Health Alliance is releasing a comprehensive state-of-the-industry report and analysis. This report is of great value to anyone involved or interested in Georgia’s bioscience, medtech & digital health industries by identifying our core strengths and assets.

Georgia Tech and Georgia Bio worked together with the Georgia Tech School of Public Policy to examine the Georgia Biotechnology Workforce. The results were compiled into a report dated May 2, 2019. The report is divided into 3 basic areas; state comparisons, industry and education perspectives. Georgia Bio is fully-funded through memberships, sponsorships, and event registration fees.

Georgia is home to a large bioscience industry that has grown at a rapid pace in recent years. The state’s bioscience firms have grown their employment base by 10.6 percent since 2014 and employed just over 32,000 in 2016. Companies have also expanded their establishment count by 16 percent during this same period and now operate 2,431 across the state. Four of the five major industry subsectors have increased employment during the 2-year period. Georgia’s research universities conducted nearly $1.1 billion in bioscience-related academic R&D in 2016; funded, in part, by a growing base of NIH awards that reached $537 million in FY 2017.