Corporate Credit Card

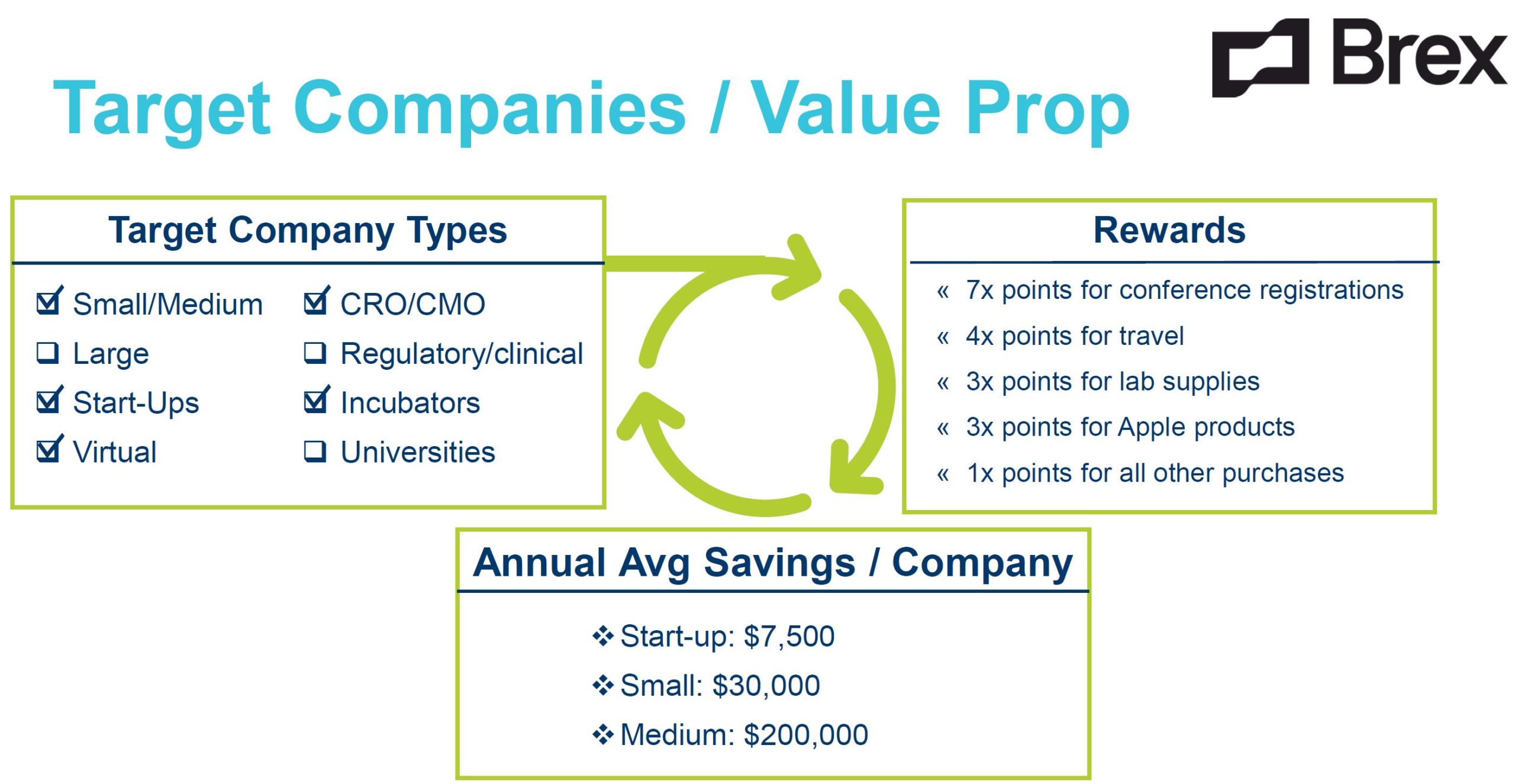

Brex, the Corporate Credit Card for the Life Sciences, is designed to empower its life sciences customers to spend less time on end of month closes and more time on life changing R&D. The card offers its customers streamlined reporting functions, rewards and unmatched controls including; no personal guarantee requirements, higher limits than traditional credit cards, instant creation of virtual cards, automatic receipt capture and, tailored rewards such as 3x points multipliers on lab equipment. Points can be redeemed as cash back to pay down statement balance, book travel, or transfer miles to select partner airlines.

Member Benefits:

- 60,000 point signup bonus

- Tailored rewards and points with 3x on lab supplies, 7x on conference registrations, and 4x on travel

- 5-minute application process (completely online) with instant access to virtual cards

- No personal guarantee or collateral requirements

Product/Service Overview

CORE PRODUCTS/SERVICES

- Brex corporate card for Life Sciences: No personal guarantees, rewards tailored for Life Sciences, seamless integration with accounting systems, higher credit limits than traditional cards, & NO FEES

- Brex Cash: Cash management alternative to a bank account

See the Savings!

Want to take advantage of these discounts?

Contact bio@brex.com or 1 (844) 725-9569